Implications and Reassurances

The Federal Reserve’s decision to cut interest rates by 50 basis points has sent ripples thorugh financial markets.

While this move is intended to stimulate economic growth, it may also have implications for various aspects of your financial life. In this blog post, we’ll explore the potential impacts of this rate cut and address common concerns, particularly the fear of an impending recession.

Understanding the Rate Cut

A rate cut means the Federal Reserve has lowered the interest rate it charges banks when they borrow money. This can lead to lower interest rates on loans and credit cards. While this may benefit borrowers, it can also impact savers and investors.

Key Implications of the Rate Cut

- Mortgage Rates:Lower interest rates typically translate to lower mortgage rates, making homeownership more affordable for many. This can boost the housing market and stimulate economic activity.

- Consumer Spending:Lower interest rates can encourage borrowing and spending, which can stimulate economic growth. However, excessive consumer debt can also be a concern.

- Stock Market:The impact of rate cuts on the stock market can be more complex. While lower rates can boost corporate profits and stock prices, they may also increase investor’s appetite for risk, potentially driving up valuations.

- Savings Rates:Lower interest rates generally mean lower returns on savings accounts and certificates of deposit (CDs). Savers may need to consider alternative investments to maintain their purchasing power. With bank depositors, the Federal Deposit Insurance Corporation insures up to $250,000 per depositor, per institution for each account ownership category.

Addressing Recession Fears

While a rate cut can sometimes signal economic weakness, it’s important to consider the broader context. The Federal Reserve carefully weighs various economic indicators when making monetary policy decisions. In this case, the rate cut may be seen as a proactive measure to support economic growth and prevent a potential recession.

Economic Indicators

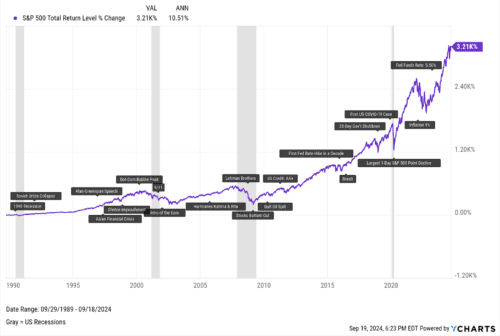

Stocks are represented by the Standard & Poor’s 500 Composite Index, an unmanaged index that is considered representative of the overall U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.

Historical Perspective:

This chart, provided by YCharts, shows that U.S. GDP has consistently risen over time, despite occasional recessions. Importantly, the S&P 500’s performance often parallels this growth, especially following recessions.

Today’s concerns about a recession are legitimate, but history shows that even when downturns occur, the economy has a proven ability to recover and thrive. The recent rate cut is a preventive measure designed to keep the economy on track for continued growth, as reflected in GDP figures. By comparing our current situation with past downturns, we can see that while market volatility is a constant, economic growth has always followed periods of decline.

Stocks are represented by the Standard & Poor’s 500 Composite Index, an unmanaged index that is considered representative of the overall U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.

Furthermore, looking at the above chart, also provided by YCharts titled “Reasons to Sell,” we can see a long-term trend of market growth despite multiple economic challenges, such as recessions, geopolitical tensions, and market corrections. The takeaway here is that while events like the recent rate cut may cause concerns regarding a potential recession, the U.S. stock market has historically demonstrated resilience and an ability to rebound.

In fact, many of the events on the chart—including the Dot-Com Bubble, 9/11, the 2008 Financial Crisis, and COVID-19—were met with significant concern at the time, but the market continued to recover and grow.

While the current economic uncertainties may seem concerning, we’ve been through comparable—and often worse—periods before, and the long-term market trend has remained upward. The Federal Reserve’s proactive decision to cut rates is intended to support continued growth, not signal recession.

Conclusion

The Federal Reserve’s recent rate cut should be seen in the context of both current economic data and the long history of the U.S. economy’s ability to navigate challenges. While concerns about a potential recession are understandable, history teaches us that proactive measures like this are often designed to avoid deeper economic downturns. The S&P 500’s historical performance shows that, even in the face of significant disruptions, the long-term trend has remained one of recovery and growth.

Similarly, the consistent rise in U.S. GDP reflects the strength and resilience of the broader economy, even after periods of uncertainty. The rate cut, rather than signaling an imminent recession, represents a step toward sustaining economic growth and stability.

Ultimately, the key is to stay informed, focus on long-term goals, and remain resilient, much like the market and economy themselves. Our team is here to help you understand how these developments affect your financial strategy and how to take advantage of the opportunities that lie ahead.

To hear more about the current economic climate, opportunities and strategies, and market hightlights join our 30-minute Quarterly Market Outlook Zoom on Friday October, 11th 2024 at Noon. REGISTER HERE

_______

The views stated in this letter are not necessarily the opinion of Cetera Advisor Networks LLC and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change with or without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results. Investors cannot invest directly in indexes. The performance of any index is not indicative of the performance of any investment and does not take into account the effects of inflation and the fees and expenses associated with investing.

All investing involves risk, including the possible loss of principal. There is no assurance that any investment strategy will be successful.

September 30, 2024